Figure 1: Global markets experience sharp declines following Trump’s tariff announcement

1. Market Turmoil: A Global Overview

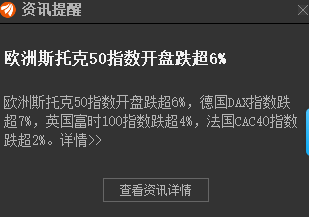

The year 2025 saw unprecedented volatility as U.S. stocks experienced a 20% freefall, with a dramatic 10% plunge occurring within just 48 hours. European indices followed suit, while Tokyo’s Nikkei and Seoul’s KOSPI indices both dropped by double digits. Central to this chaos was Donald Trump’s aggressive re-escalation of global trade tensions through punitive tariffs on major trading partners.

Figure 2: S&P 500 performance during tariff announcement week

For retail investors caught in this storm, two critical truths emerged:

- Government intervention is inevitable – Central banks and sovereign wealth funds (SWFs) deploy stabilization measures during systemic crises

- Short-term prediction is futile – Even seasoned analysts struggle to forecast policy responses in real time

2. Why Trust National Teams?

State-backed investment entities – colloquially known as “national teams” – serve as critical market stabilizers. Their advantages include:

- Access to real-time economic data and policy insights unavailable to public investors

- Strategic purchasing power focused on index-heavyweight stocks

- Long-term investment horizons immune to daily fluctuations

Figure 3: Historical intervention patterns by major SWFs

China’s Central Huijin provided a prime example during the 2025 crisis, announcing market support measures while maintaining strategic silence on specific intervention volumes.

3. Decoding Market Signals: The “Controlled Decline” Hypothesis

China’s A-share market experienced an anomalous 7.34% single-day collapse following Trump’s tariff announcement. Key anomalies included:

- Unusually low trading volumes despite significant price movements

- State-owned enterprises (SOEs) hitting daily loss limits without intervention

“This controlled decline suggests authorities are allowing markets to find natural support levels before implementing major stabilization measures.”

– Goldman Sachs Emerging Markets Report, April 2025

Figure 4: Trading volume vs price movement analysis for SSE Composite Index

4. Global Reactions: Alliances Against Unilateralism

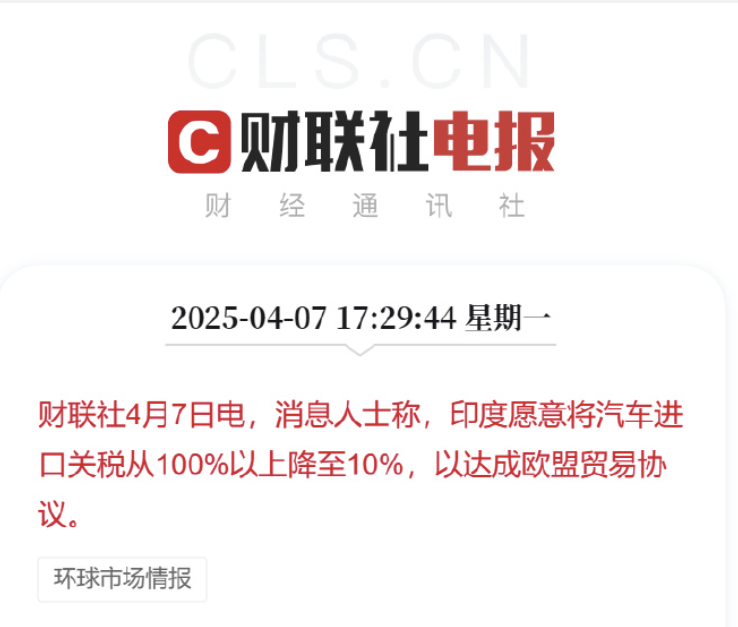

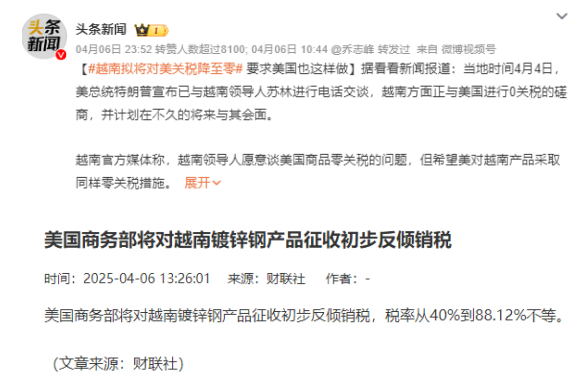

Trump’s protectionist policies accelerated global counter-alignment:

- European Union imposed $28B in retaliatory tariffs targeting U.S. agricultural exports

- India reduced automotive import duties from 100% to 10% for European manufacturers

- U.S. states like California and New York openly defied federal trade policies

Figures 5a & 5b: Global trade counter-measures visualization

5. Wild Swings: The Impact of Disinformation

A false rumor about tariff delays created a 6.5% intraday surge in U.S. markets, only to collapse when officially denied. This demonstrated:

- The extreme sensitivity of markets to unverified information

- The dangers of reactive trading in volatile environments

Figure 6: S&P 500 intraday volatility following false tariff delay report

6. Survival Guide for Investors

Short-Term Strategies

- Monitor SWF buying patterns – These often signal market bottoms

- Maintain cash reserves to capitalize on dislocations

- Avoid margin trading during periods of extreme volatility

Long-Term Plays

- Focus on dividend aristocrats with 5%+ yields

- Diversify across geopolitically stable markets

- Underweight tariff-sensitive sectors like technology hardware

Critical Risks to Avoid

- Leveraged ETFs that amplify losses

- Emotional decision-making during flash crashes

- Overconcentration in single-country equities

7. Conclusion: The Power of Patience

While Trump’s policies created unprecedented uncertainty, historical data shows tariff wars eventually lose momentum. By focusing on quality assets and systemic safeguards, investors can weather the storm. As Morgan Stanley’s chief strategist noted:

“Markets recover faster than they fall. The key is remaining invested through the cycle.”

Figure 7: Post-crisis market recovery analysis (1930-2025)