html

Escalation of China-US Trade Dispute: A Game with No Winners

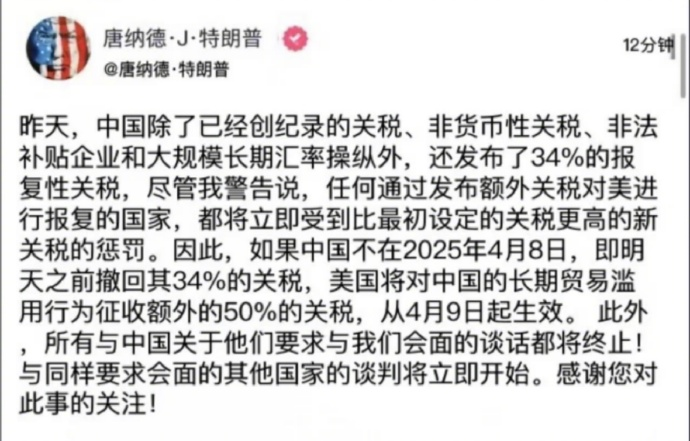

The world’s two largest economies stand at a critical juncture as the US issues an ultimatum demanding China cancel 34% tariffs within 24 hours or face 50% punitive tariffs on $500 billion worth of goods. This high-stakes game threatens global economic stability – but understanding the nuances is key to navigating the turbulence ahead.

1. Timeline of Events

April 7th: US President’s social media ultimatum sets 24-hour deadline.

April 8th: China’s Ministry of Commerce vows “necessary countermeasures” while emphasizing dialogue principles.

2. China’s Strategic Response

- Agriculture: 70% tariffs on soybeans/sorghum; poultry import suspensions

- Healthcare: Termination of fentanyl control cooperation

- Entertainment: US film distribution restrictions

- Tech: IP reviews for American companies

3. Real-World Impact Analysis

104% total tariffs would double Chinese goods’ US prices, devastating electronics/machinery supply chains.

Trade as % of China’s GDP: 2.3% (down from 18% in 2018) – yet domestic retail sales hit $6.5 trillion by 2023.

4. Strategic Miscalculations

US Missteps: Overestimating export pressure leverage, underestimating China’s manufacturing adaptability and 1.4 billion-person market potential.

China’s Red Lines: Rejecting unilateral threats while securing 35% semiconductor localization – and maintaining global supply chain stability.

5. Global Ripple Effects

- Apple shifting 15% iPhone production to India

- Tesla Shanghai exports down 12% YoY

- RMB fluctuations hitting 1.2% daily extremes

- Shipping costs in South China Sea up 40%

6. Business Survival Tactics

Smart strategies: Vietnam/Malaysia transit warehouses, product reclassification (smartwatches → medical devices), TikTok Shop’s 300% YoY growth

Tech upgrade case study: Shenzhen factory’s AI system boosting efficiency 25% while cutting labor costs 40%

7. Long-Term Power Dynamics

- 30 Dongfeng-41 missiles deployed

- Fujian carrier completes advanced testing

- Huawei’s 5G rebound to 25% market share

- Domestic EV penetration over 35%

8. Historical Parallels & Warnings

1930s tariffs shrank global trade 66% – today’s $2 trillion cross-border e-commerce and RCEP’s 30% trade share offer hope.

Full decoupling could vaporize $1.5 trillion from global GDP – equivalent to Australia’s entire economy.

9. Citizen Action Guide

Investors: 15-20% gold allocation; ASEAN ETFs

Traders: AEO certification cuts customs time by half; master live cross-border sales

Consumers: Brace for 10-15% import price hikes; explore Xiaomi/BYD alternatives

10. Future Scenarios

- Short-Term (6 months): Partial tariff exemptions; RMB 7.0-7.3 range

- Mid-Term (1-3 years): Mexico as top US trade partner; ASEAN intra-trade at 28%

- Long-Term (5-10 years): “Dual circulation” systems; digital/carbon tariff battles

Conclusion: This century’s power struggle between established order guardians and rising powers demands China’s strategic focus on high-tech breakthroughs. As the New York Times warns: “When giants clash, prepare bandages, not bets.”