html

The Latest Development of the US-China Tariff Game: The Strategic Battle Behind a Numbers Game

[Introduction] Recently, the US-China tariff dispute has once again triggered global attention. The seemingly complicated game of tariff numbers actually hides the strategic considerations and economic tug-of-war between the two sides. This article will analyze the ins and outs of the incident in layman’s language, and bring you to understand the business logic behind the exchanges between big countries.

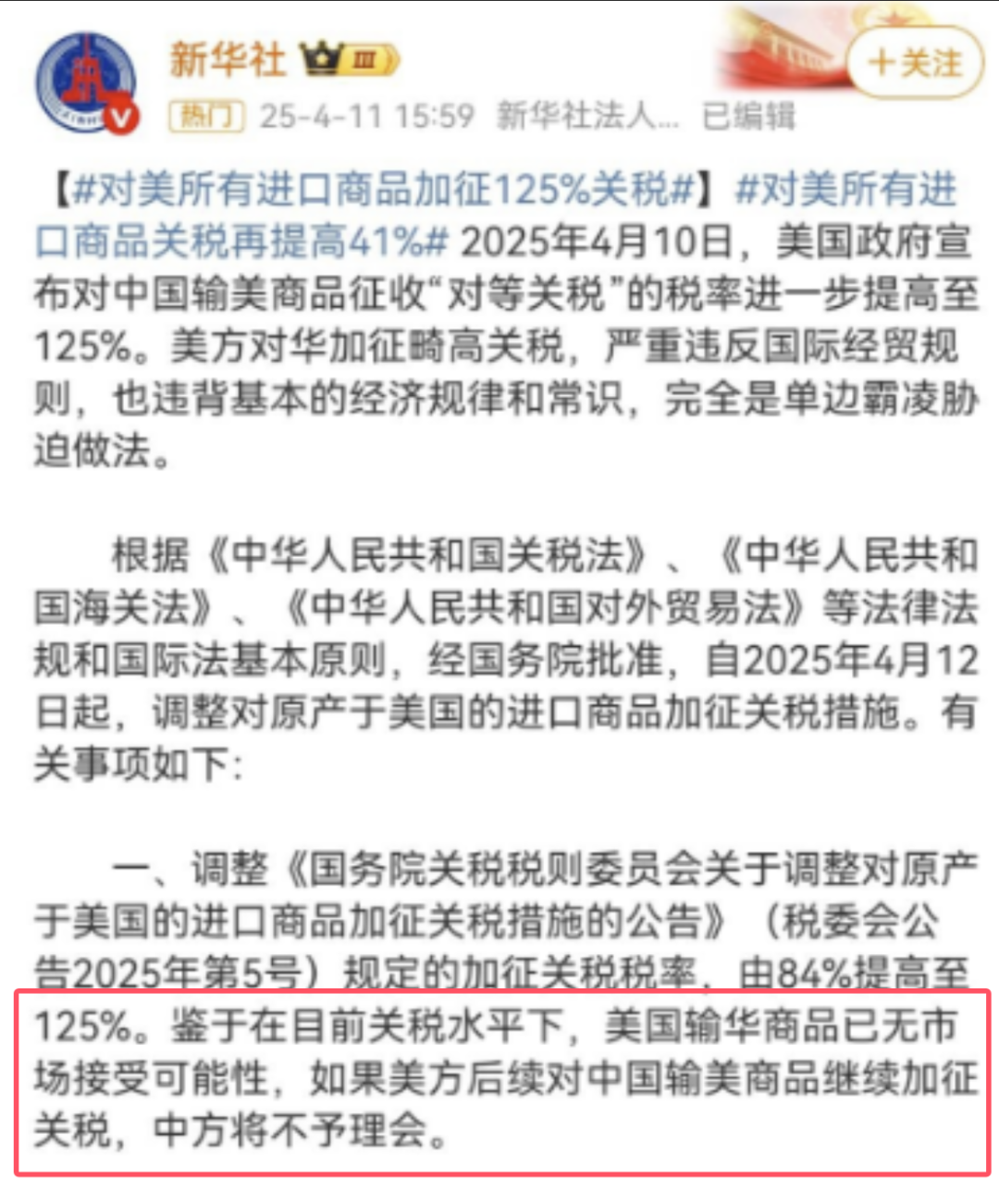

I. Subtle Changes in Tariff Figures

The U.S. government recently announced a 125% tariff on Chinese goods. However, according to the White House’s follow-up statement, the 125% was added on top of the original 20% tariff, and the actual total tax rate amounted to 145%. China then announced a reciprocal 41% tariff increase, bringing the total tariffs to the U.S. to a similar 145%.

It should be noted that:

- These figures mainly apply to specific sensitive commodities

- Regular tariffs are still applied to ordinary traded goods

- There are circumvention means such as re-export trade in the actual implementation of the

II. The Key Turning Point of the Chip War

In the tariff game, the chip has become the core battleground:

- The U.S. originally planned to restrict the export of H20 chips (high-end computing chips) to China, but ultimately chose to hold off

- China modified the rules for determining the origin of chips, taking the “place of chip flow” (the location of the core process of chip manufacturing) as the basis for levying tariffs

- This means that chips produced in the U.S., even if packaged in a third country, will still be subject to a tariff of 145%

Comparison of data:

China’s chip industry data for 2024

- Total output value: $315 billion (formerly 2.3 trillion RMB)

- Exports: $137 billion (formerly 1 trillion RMB)

- Self-sufficiency rate: from 30% to 95%

III. Real-World Impacts of the Trade War

For the Average Consumer:

- U.S. supermarkets have begun to individually mark the tariff amount on the small ticket

- Economists estimate that the tariffs have increased U.S. households’ annual spending by about $4,000

- Possible price fluctuations for imported cars, electronics, etc. from China

Impact on Businesses:

- Low-end goods can avoid high tariffs through re-exports (e.g., transshipment through Vietnam, Mexico)

- Branded goods are difficult to avoid due to clear identification of origin (e.g. iPhone, Ford cars)

- Chips and other high-tech products have become the focus of regulation

IV. The Political Game Behind

Dilemma faced by the Trump administration:

- The need to maintain the image of “tough on China” to win the support of voters

- Actual pressure from enterprises and consumers

China adopts a “graded response” strategy:

- Ignore the pure numbers game (only raising tax rates)

- Counteract substantive damages

Typical example:

China’s import policy adjustment on US movies

- Original plan: total ban

- Current policy: moderately reduce import quotas

This flexible treatment leaves room for subsequent negotiations.

V. Possible Future Directions

Short-term forecast (1-2 years):

- Tariff figures may continue to climb “symbolically”

- Re-exports to increase significantly

- Both sides to remain engaged in negotiations

Medium- to long-term trends:

- Accelerated substitution of China’s chip industry (40% increase in production capacity annually)

- U.S. agricultural industry to increase production capacity by 40%. (40% increase in annual production capacity)

- U.S. agricultural exports seek new markets

- Third-party countries (e.g., Vietnam, Mexico) become transit points for trade

VI. Strategies for the Common Man

For Importers:

- Establish a diversified supply chain

- Focus on FTZ policies

- Make good use of re-export trade rules

For Consumers:

- Compare prices of goods from different channels

- Focus on alternative products (e.g. Chinese chip phones)

- Understand that short-term fluctuations are normal market reactions

For Investors:

- Focus on semiconductors, agriculture

- Keep an eye on port logistics companies

- Cautiously assess the valuation of multinational brands

【Conclusion】

The essence of this tariff game is the fight for technological dominance. As industry insiders have pointed out, “The winners and losers of the chip war will determine the pattern of the global economy in the next decade.” As China breaks through technological barriers in key areas, the rules of international trade are undergoing a profound reconfiguration. The general public need not worry too much about the numbers game, and should pay more attention to the technological progress and market opportunities of the real industry.