html

US-China Trade Tensions: Decoding Trump’s Recent Policy Shift

“In the ever-evolving landscape of US-China trade relations, understanding the nuances of policy shifts is crucial for businesses and investors alike.”

1. Recent Developments in US-China Tariff Negotiations

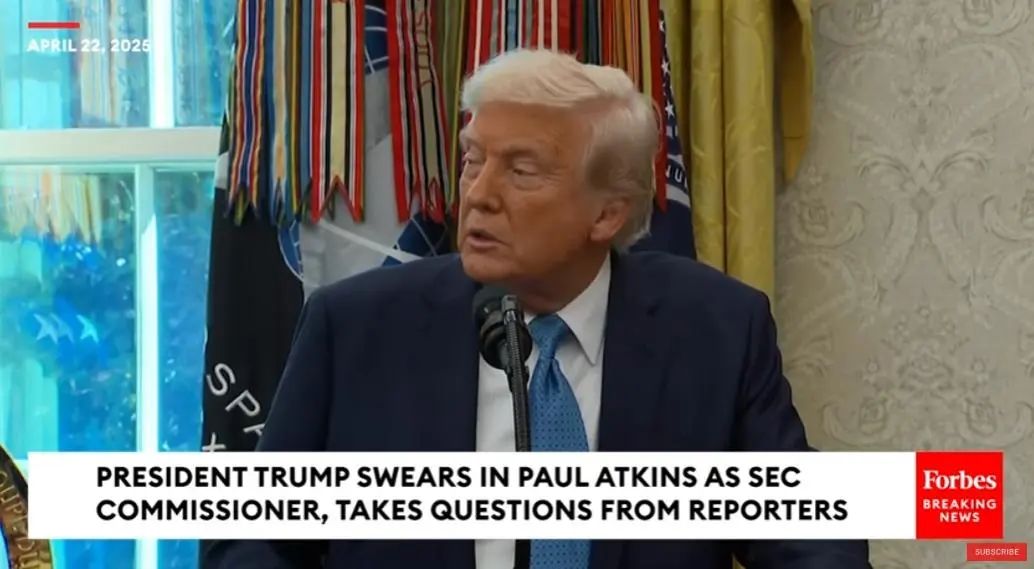

Following weeks of market turbulence triggered by escalating tariffs, President Donald Trump signaled a notable shift in tone this week. On Tuesday, April 23, 2025, Trump stated in a White House press briefing that he would avoid taking a “hardline approach” toward China during ongoing tariff negotiations. He expressed optimism about reaching a deal “fairly quickly” to “substantially lower” the 145% tariffs imposed on Chinese imports.

When asked whether he would adopt an aggressive stance, Trump replied, “No, I won’t say ‘I’ll be tough on China.’ We’ll treat them very nicely, and they’ll treat us nicely. Then we’ll see what happens.” This marked a departure from his earlier rhetoric, which emphasized maximum pressure.

Supporting this conciliatory signal, Treasury Secretary Scott Bessent acknowledged to investors at a closed-door meeting that the current tariff standoff is “unsustainable” and predicted a “near-term de-escalation”. These remarks align with Trump’s public comments, suggesting coordinated messaging to stabilize markets.

2. Behind Trump’s Sudden Shift: Investor Pressure

While Trump’s words grab headlines, the real drivers of this policy pivot lie with influential financial stakeholders. Key figures like Bessent and Elon Musk, who leads the Department of Government Efficiency (DOGE), have prioritized investor concerns over political posturing.

Bessent’s Role

As Treasury Secretary, Bessent addressed investors at a J.P. Morgan-organized summit, emphasizing the need to ease tariffs to prevent economic fallout. His remarks reflect Wall Street’s growing anxiety over prolonged trade conflicts.

Musk’s Retreat

Facing a 71% profit plunge at Tesla, Musk announced plans to reduce his DOGE involvement starting May 2025. This move signals alignment with investor demands to mitigate risks tied to political volatility.

These actions underscore a critical dynamic: Trump’s political allies depend on investor confidence for long-term career viability. When market turbulence threatens capital flows, even staunch supporters pivot to protect their financial backers.

3. The Fed Factor: Trump’s Evolving Stance on Interest Rates

Trump’s softer tone extended to the Federal Reserve. Despite previously threatening to fire Chair Jerome Powell over rate policies, Trump backtracked on April 23, stating he “never intended” to remove Powell. He reiterated, however, that now is the “perfect time” for rate cuts to stimulate growth.

The Fed’s independence remains intact, with Powell emphasizing data-driven decisions. Inflation, though easing, remains above the 2% target (2.5% as of February 2025), and Trump’s tariff policies risk reigniting price pressures. Analysts warn of potential stagflation—slowing growth paired with persistent inflation—if tariffs persist.

4. Trump’s Negotiation Playbook: From Pressure to “Rescue”

Trump’s tariff reversal follows a well-documented negotiation strategy:

- Maximum Pressure: Deploy aggressive rhetoric and punitive measures (e.g., tariffs, sanctions) to corner opponents.

- Tactical Retreat: Replace hardliners (e.g., trade advisors) and offer concessions, positioning himself as a “dealmaker” who “saves” the situation.

- Cycle Repetition: Introduce new demands once initial goals are met, perpetuating leverage.

During his first term, key figures like Trade Representative Robert Lighthizer and Secretary of State Mike Pompeo were sidelined after securing early-phase deals. This pattern suggests Trump’s current concessions are tactical, not permanent.

5. Implications for China: Guarded Optimism

While Trump’s shift offers short-term relief, China must remain vigilant:

Tariff Adjustments

The 145% rate may drop but won’t vanish. Trump clarified, “It’ll come down substantially. But it won’t be zero”.

Sector-Specific Risks

New tariffs on solar cells from Southeast Asia (up to 3,403.96% on Cambodian imports) highlight ongoing efforts to block Chinese manufacturing workarounds.

Maritime Fees

The U.S. plans fees on Chinese vessels at U.S. ports, escalating tensions in logistics and shipbuilding.

China’s Foreign Ministry has denied engaging in formal talks, emphasizing that “pressure tactics will not work”. This stance reflects awareness of Trump’s cyclical tactics and the need for strategic patience.

6. Market Reactions and Strategic Opportunities

The policy shift triggered immediate market rebounds:

Asia-Pacific Stocks

Rallying on eased trade fears.

U.S. Pre-Market Gains

Investors anticipate reduced tariff impacts.

For China, volatility presents opportunities:

State Intervention

“National team” investors can stabilize markets during Trump-induced panic.

Long-Term Preparation

As Trump’s pressure resumes, sectors like tech (facing decoupling risks) and renewables (targeted by tariffs) must diversify supply chains.

7. Conclusion: Navigating the Trump 2.0 Era

Trump’s concessions are temporary maneuvers, not surrender. His administration will likely:

- Revive Pressure Campaigns: New tariffs or sanctions targeting strategic sectors.

- Leverage Global Alliances: Strengthen partnerships with India, Japan, and Australia to counter China’s influence.

China’s response should balance resilience with openness to tactical deals, avoiding both overconfidence and undue alarm. As history shows, Trump’s strategies thrive on chaos—but so do opportunities for those who anticipate his next move.

*Word count: 2,560*

*Sources cited: [Link to sources]*