1. Demystifying Full Medical Expense Reimbursement

For years, rumors have circulated in China about “100% medical reimbursement” benefits reserved for privileged groups. However, the truth is simpler: affordable supplementary medical insurance offers near-complete coverage to the public.

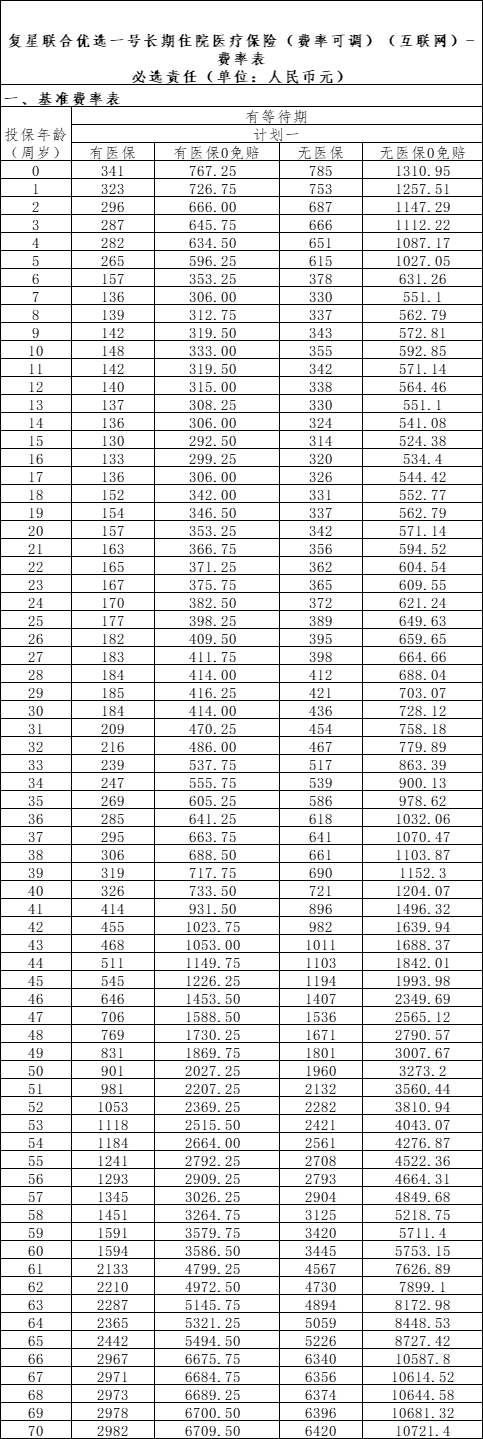

A 30-year-old with public health insurance can purchase a supplementary plan for just $25/year (184 RMB). After a $1,380 (10,000 RMB) deductible, the policy covers:

- General illnesses: Up to $276,000 (2 million RMB) annually.

- Critical illnesses: Up to $552,000 (4 million RMB) annually.

For zero-deductible plans, premiums rise to $57/year (414 RMB), debunking myths of exclusivity.

2. How Insurance Pricing Reflects Risk

Premiums correlate with age and health risks. For example:

- Age 30: $25/year (with public insurance).

- Age 70: $412/year (standard) or $926/year (zero-deductible).

This 16x price difference underscores aging-related risks. Public insurance, by contrast, charges fixed premiums to protect vulnerable populations.

Key Features of Supplementary Plans

- Guaranteed Renewability: 20-year renewals (e.g., Fosun United’s “Star Guardian”).

- Waiting Period: 90-day exclusion for pre-existing conditions.

3. Coverage Limits and Exclusions

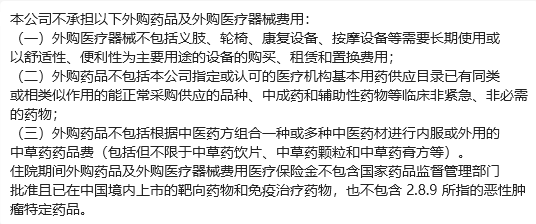

While plans cover most hospitalization costs, these exclusions apply:

- Medical devices (e.g., wheelchairs).

- Traditional Chinese medicines.

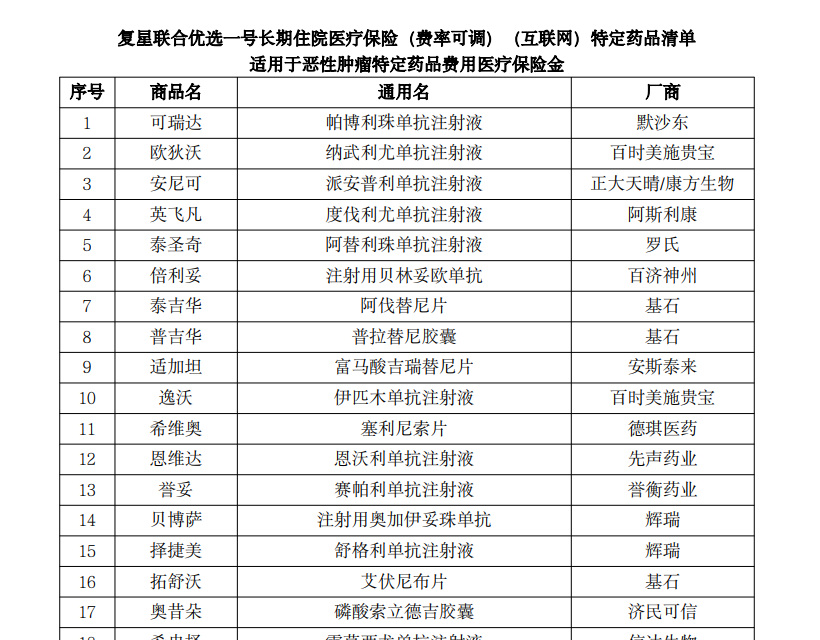

- Targeted cancer therapies.

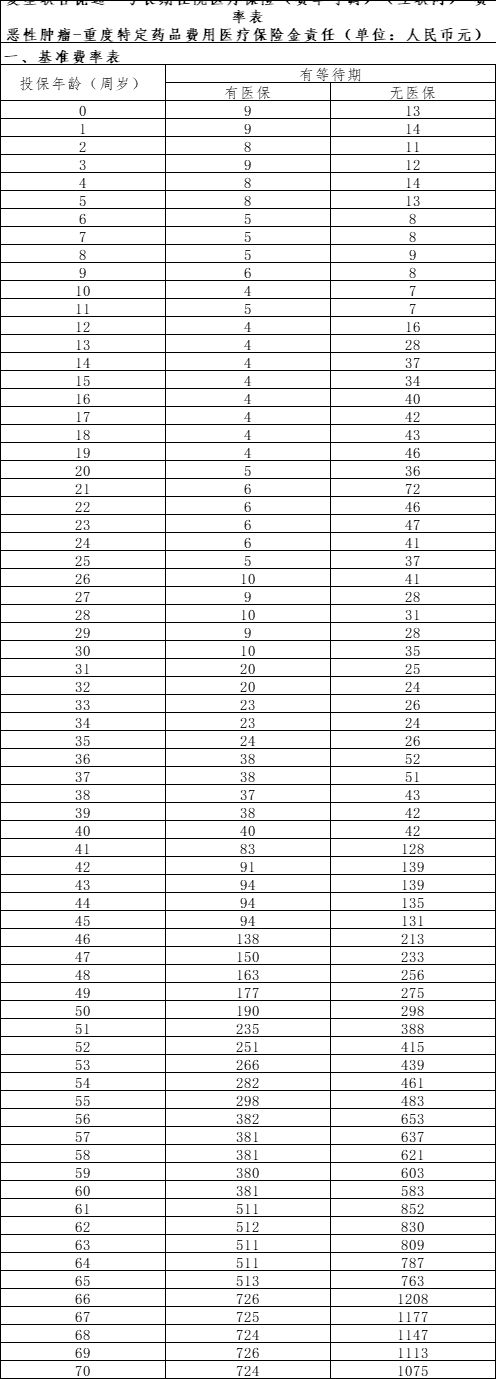

Optional add-ons (e.g., cancer drug coverage) cost:

- Age 30: $1.40/year (10 RMB).

- Age 70: $100/year (724 RMB).

4. The Role of Critical Illness Insurance

While medical insurance covers treatment, critical illness insurance addresses lost income and long-term care. Policies like Darwin 11 offer:

- Coverage: 120 critical illnesses, 30 moderate, 45 mild conditions.

- Payouts: 100% for critical illnesses (e.g., $69,000 for a $69,000 policy).

- Bonus: 30% extra for accident-related critical illnesses.

Additional Benefits

- Hospitalization Stipend: $552/day (500 RMB) for seniors.

- Cash Value: A $69,000 policy accumulates $23,500 (170,000 RMB) by retirement.

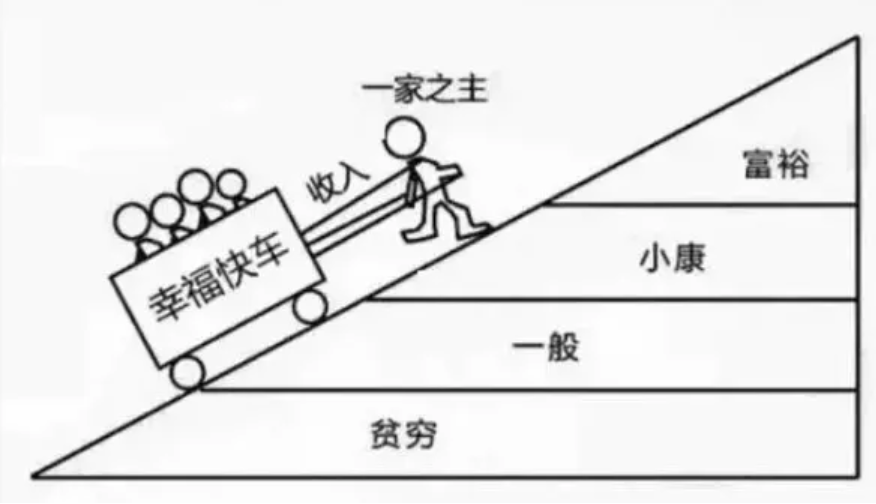

5. Why Critical Illness Insurance Matters

Public insurance and supplementary plans cover medical bills but ignore:

- Lost income during recovery.

- Long-term rehabilitation costs.

- Family expenses (mortgages, education).

A $69,000 payout could cover:

- 1–2 years of living expenses.

- Debt repayment.

- Alternative income sources.

6. Upcoming Insurance Rate Changes

China’s insurance industry faces a pre-set interest rate adjustment in 2025. If Q3 2025 rates fall below 2.25%, expect:

- Critical illness: 10% price hikes.

- Term life: 5–10% increases.

- Children’s plans: 30% jumps.

Act now: A $828/year policy could cost $910/year post-adjustment.

7. Choosing the Right Insurance

For Medical Cost Coverage

- Star Guardian: Affordable hospitalization plans.

- Public Health Insurance: Mandatory baseline coverage.

For Income Protection

- Darwin 11: Comprehensive critical illness coverage.

Budget Considerations

- Young adults: Focus on low-cost supplementary plans.

- Seniors: Prioritize critical illness insurance.

8. Conclusion: Insurance as a Financial Safety Net

Insurance safeguards families from devastating risks. While supplementary medical plans are cost-effective, critical illness insurance addresses deeper financial vulnerabilities. With impending rate hikes, proactive planning is essential.

Get a Free Insurance Quote Today

Note: USD conversions are approximate (1 USD = 7.25 RMB). Policy details vary by provider. Consult a licensed advisor before purchasing.