html

Recently, the United States announced that it would substantially raise tariffs on goods from many countries around the world and demanded that countries refrain from taking reciprocal measures in response. This policy has triggered widespread concern in the international community. In response, China quickly took firm reciprocal countermeasures. The following is a detailed analysis of the whole incident, and we will explain the complex economic concepts in an easy-to-understand way.

1. Timeline of the U.S.-China tariff game

1.1 First round of tariff hikes and countermeasures

On March 15, the U.S. government announced that it had imposed a 20% base tariff + 34% punitive tariffs on Chinese goods, bringing the total tariff rate to 54%. China announced tariff increases of the same magnitude on U.S. goods within 24 hours, bringing the average tariff rate on U.S. goods in China to over 50% as well. This made China the first country to formally counter U.S. tariff policies.

1.2 Threat Escalation and Secondary Countermeasures

In the face of China’s countermeasures, the U.S. issued an ultimatum on April 5: it demanded that China cancel its countermeasures by April 8th. On April 8, China not only refused to withdraw the tariffs, but also announced a countermeasure package containing six specific measures, and on April 9, the U.S. raised tariffs on Chinese goods to 104 percent (54 percent base + 50 percent new), while suggesting that it was “looking forward to the Chinese side’s call for consultation”.

1.3 Rapid Response

China raised tariffs on U.S. goods to 84% new + original base, totaling more than 100%, just hours after the U.S. announced the 104% tariffs. This rapid response stems from the nature of modern trade: when tariffs exceed the “death rate” (about 20%), continuing to raise tariffs has limited impact on actual trade.

2. The Economic Logic Behind the Tariff War

2.1 The Death Rate Phenomenon

The average profit margin in modern manufacturing is only 5-10%, and tariffs above 20% make imported goods uncompetitive. This is what economists call the “death tariff rate” – beyond this threshold, tariffs continue to rise more as a political statement than as an economic reality.

2.2 The Buffering Effect of Re-exports

The cost of re-exporting through a third country increases by only 3-5%:

- Chinese goods can be re-exported into the US via Vietnam

- US goods can be re-exported into China via Hong Kong

This pattern of trade makes the real impact of extremely high tariffs much weaker.

3. Comparison of International Responses

3.1 The Special Case of Israel

As the only country to fully cooperate with the U.S., Israel has committed to:

- Reducing tariffs on U.S. goods to 0%

- Purchasing $7 billion of U.S. goods annually

In exchange, however, Israel receives:

- $4 billion in direct financial aid

- $4 billion in military aid

Cumulatively, it has received more than $310 billion in aid since its founding.

3.2 The Waiting and Seeing Attitudes of Other Countries

Japan and South Korea were forced to negotiate due to special political relations, but most countries chose to keep their distance after seeing the Israeli case. Major economies such as the EU and ASEAN have not made substantial concessions.

4. Realistic Impact of Tariff War

4.1 Conflicts within the United States

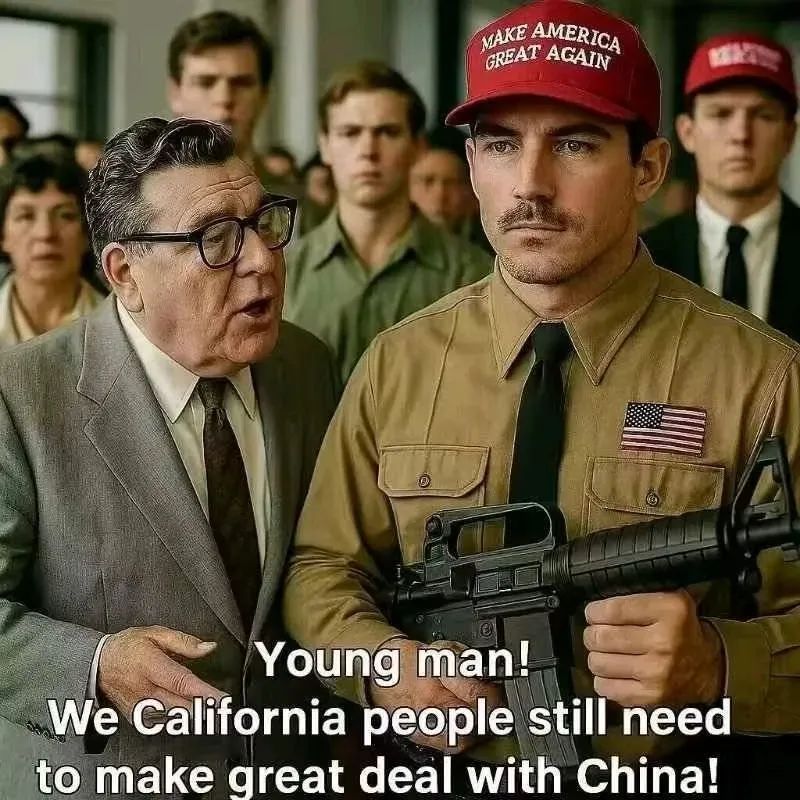

California (GDP $3.9 trillion, world’s fifth largest economy) openly opposes tariff policy:

- Demands autonomy to conduct foreign trade negotiations

- Threatens to withhold federal taxes (14% of the whole U.S.)

- Appeals to international partners to treat it as an independent economic entity

4.2 Chain Reactions in the Field of Citizens’ Livelihoods

Ordinary U.S. consumers are already starting to feel the pressure on prices:

- The prices of Chinese-made daily necessities have increased by 15 percent.

- Maintenance costs of electronic products have increased by 30%.

- Prices of building materials have risen by 25% (data for April 2024).

5. Underlying Logic of the Trade War

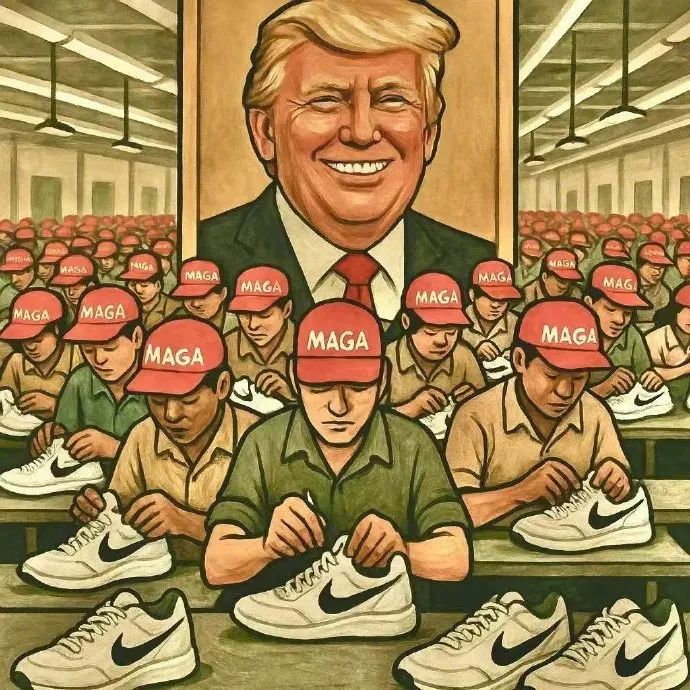

5.1 Fundamental Differences in Economic Structures

China possesses a complete industrial chain:

- Out of the 500 major industrial products, 220 are the world’s largest in terms of production.

- 70% of the world’s smartphones and 90% of the world’s personal computers are produced in China.

The US, on the other hand, is highly dependent on the service sector:

- Services account for 80% of GDP.

- Manufacturing employs only 8% of the population.

5.2 The special status of the US Dollar

China holds more than US$3 trillion in foreign exchange reserves, but:

- There is a limited number of US high-tech products that can be purchased.

- Rudimentary necessities such as agricultural products, medical products, and so on, are not subject to the tariffs.

This makes the direct impact of the tariff war on the livelihood of the Chinese people controllable.

6. Forecast of Future Development Trends

6.1 Short-term Market Volatility

In the next 6 months, it is expected that:

- Southeast Asian re-export trade volume will increase by 30-50%.

- Smuggling activities in Central America will increase.

- Inventory turnover cycle of U.S. retailers will be lengthened by 15 days.

6.2 Long-Term Structural Changes

It may give rise to:

- Development of regional currency settlement system (users of the RMB cross-border payment system, CIPS, have already covered 180 countries).

- Cross-border e-commerce platforms Upgraded logistics system (e.g. Cainiao added 12 new charter flight routes between China and the US).

- Intelligent manufacturing accelerating the replacement of traditional production (China’s industrial robot density reached 322 robots per 10,000 people).

7. Coping Strategies for Ordinary People

7.1 Attention for Chinese Consumers

- Imported alternatives to choose from: prices of domestic goods of the same quality are 15-30% lower.

- Focus on cross-border shopping timeliness: the average logistic time may be extended by 3-5 days.

7.2 U.S. Consumer Advice

- Stock up on consumer durables in advance (e.g., consider extending the replacement cycle of home appliances by 1-2 years).

- Learn basic repair skills (YouTube instructional videos have increased by 200% month-over-month).

Conclusion

This tariff game is essentially a structural adjustment in the globalization process. For the general public, understanding the core concepts such as the “death rate” and paying attention to the actual buffer mechanism such as re-export trade will enable them to rationally view the changes in various tariff figures. Historical experience has shown (the 1995 US-Japan trade war and the 2018 US-China friction) that market forces will eventually push all parties to return to pragmatic negotiations. By maintaining an understanding of basic economic laws, we can seize the initiative in this war without smoke.