html

Understanding America’s Debt Crisis in 2025

“We’re not drowning yet, but the water is rising faster than we can swim.” – A Treasury Official

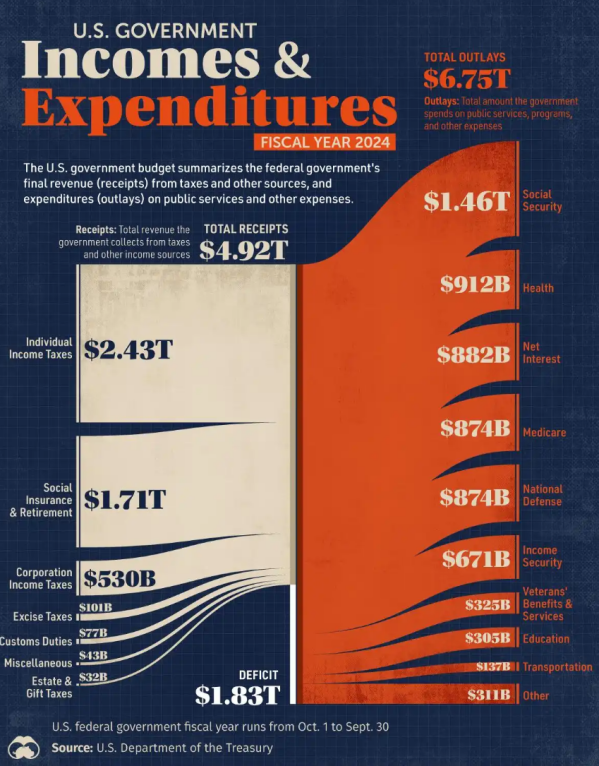

As of April 2025, the total U.S. federal debt has surged to an alarming $37.3 trillion, equivalent to 35% of global GDP. With a population of 335 million, this translates to over $110,000 in debt per American citizen. This staggering figure stems from years of unchecked government spending and widening budget deficits. In 2024 alone, the U.S. government collected $4.9 trillion in revenue but spent $6.8 trillion, resulting in a $1.9 trillion deficit—adding approximately $5 billion in new debt daily.

This article breaks down the causes, challenges, and potential consequences of America’s debt crisis in simple terms, focusing on how the Trump administration is navigating this financial turmoil.

1. The Rising U.S. Debt Crisis

Why Is the Debt So High?

The U.S. government has run annual budget deficits for over two decades. Key figures include:

- 2023: $1.66 trillion deficit

- 2022: $1.38 trillion

- 2021: $2.77 trillion (pandemic-related spending)

- 2020: $3.13 trillion (COVID-19 relief)

- 2019: $0.98 trillion

The Biden administration’s pandemic-era policies, including stimulus checks and healthcare funding, temporarily boosted GDP by 24% but also fueled inflation. Basic necessities like eggs, milk, bread, and rent rose by 30-50%, outpacing wage growth and eroding public trust in economic management.

U.S. Debt Growth Over the Years

Interest Payments: A Growing Burden

Debt isn’t free. The U.S. paid:

- 2024: $1.1 trillion in interest

- 2023: $1.02 trillion

- 2022: $830 billion

- 2021: $612 billion

- 2020: $338 billion (low-rate environment)

By 2025, daily interest payments reached $320 million. To put this in perspective, the U.S. now spends more on debt interest than on defense ($886 billion in 2024) or Medicare ($829 billion).

2. Trump’s Austerity Measures: Cutting Costs

Upon returning to office in January 2025, President Trump prioritized fiscal reform. His strategy focused on reducing wasteful spending through the newly formed Government Efficiency Department (DOGE), led by Elon Musk.

Key Achievements of DOGE (2025):

- Staff Cuts: 30,000 federal employees laid off; 75,000 opted for buyouts.

- Agency Closures: The U.S. Agency for International Development (USAID) was reduced from 9,600 employees to 600.

- Budget Freezes: Canceled $130 billion in “questionable” projects, including:

- $220 million for free housing/vehicles for undocumented immigrants.

- $45 million for DEI scholarships in Myanmar.

- $80 million for LGBT advocacy in Africa.

- $19 billion for a “Home Decarbonization Committee”.

DOGE’s Key Achievements in 2025

Limitations of Cost-Cutting

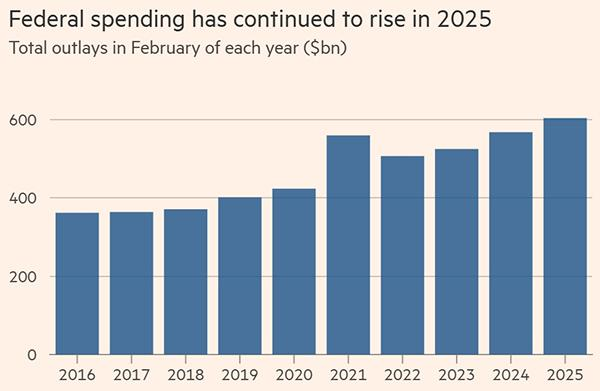

Despite these efforts, DOGE’s savings ($130-$150 billion) barely offset new spending. For example, February 2025 saw federal expenditures rise by $40 billion year-over-year, driven by healthcare (+$5 billion) and Social Security (+$8 billion).

3. Untouchable Giants: Healthcare and Military-Industrial Complex

Healthcare: A $5 Trillion Black Hole

The U.S. healthcare system consumes $5 trillion annually—more than China’s entire healthcare budget ($1.37 trillion for 1.4 billion people). Key issues:

- Hospital stays cost $3,000/day on average.

- Private insurance premiums average $9,000/year per person.

- 30 million Americans (9%) lack coverage due to unaffordable costs.

Why Reform Fails

Powerful lobbies—hospitals, insurers, pharmaceutical companies—block meaningful reform. For instance, attempts to lower drug prices or expand Medicare have repeatedly stalled in Congress. Trump’s DOGE avoided tackling healthcare entirely, focusing instead on smaller targets like USAID.

U.S. Healthcare Costs vs. Global Standards

Military-Industrial Complex

Defense spending ($1.1 trillion in 2024) faces similar resistance. Projects like the F-35 fighter jet ($1.7 trillion lifetime cost) or naval expansions are politically untouchable, despite audits revealing billions in waste.

4. Tariff Wars: A Desperate Bid for Revenue

In April 2025, Trump launched a global tariff campaign, targeting allies and rivals alike. The goal: Generate $730 billion annually (about $2 billion/day) to offset debt interest.

How Tariffs Work

- 10-245% tariffs on imports like steel, aluminum, and electric vehicles.

- Targets: China, EU nations, Mexico, and Southeast Asia.

Mixed Results

- Short-Term Gains: Tariff revenue rose by $20 billion/month by March 2025.

- Backlash: Retaliatory tariffs from China and the EU hurt U.S. exporters. For example, soybean farmers lost $12 billion in EU markets.

Impact of U.S. Tariffs on Global Trade

5. Systemic Roadblocks: Political Rot

The “Revolving Door” Problem

U.S. politicians often transition to lucrative corporate roles post-office, creating conflicts of interest. For example:

- Defense Secretaries frequently join Raytheon or Lockheed Martin boards.

- Health Secretaries lobby for pharmaceutical giants like Pfizer.

This cycle entrenches corruption, as lawmakers prioritize corporate donors over public welfare.

Failed Reforms

Trump’s proposals to:

- Eliminate “bureaucratic waste” in healthcare/military.

- Ban lobbying by former officials.

- Implement term limits.

…were blocked by Congress, where 73% of members receive corporate PAC funds.

6. What’s Next for the U.S. Economy?

Debt Refinancing Challenges

In 2025, $10.8 trillion in Treasury bonds will mature, requiring refinancing at higher rates (4.5-5.5%). If foreign buyers like Japan or China reduce holdings, the Federal Reserve may be forced to print money—triggering hyperinflation.

Global Loss of Confidence

- Foreign Reserves: Japan ($1.08 trillion) and China ($760 billion) have already cut U.S. debt holdings.

- Dollar Dominance: The dollar’s share in global reserves fell to 54% in 2025 (down from 71% in 2000).

Long-Term Projections

The Congressional Budget Office (CBO) warns:

- Debt-to-GDP ratio will hit 185% by 2053.

- Annual interest payments could reach $5.4 trillion—exceeding Social Security and Medicare combined.

Conclusion

The U.S. debt crisis is a slow-motion disaster fueled by political gridlock, corporate greed, and unsustainable spending. While Trump’s austerity measures and tariffs provide temporary relief, they fail to address systemic rot in healthcare, defense, and governance. Without sweeping reforms—such as breaking up monopolies or closing the “revolving door”—the nation risks a fiscal collapse that could destabilize the global economy.

For now, the U.S. remains the world’s largest economy, but its window to avert disaster is narrowing rapidly.