1. Historical Context of A-Share Market Trends

1.1 The Record-Breaking 11-Day Rally

The A-share market’s recent 9-day consecutive rise (ending last week) revived memories of its historic 11-day streak—a milestone achieved only twice since the 1990s:

- 2006 Rally: Coincided with full circulation reforms, marking a watershed moment in market liberalization.

- 2025 Echo: Matched the 2006 peak, underscoring institutional confidence in controlled growth.

Unlike the 1990s’ 99-day speculative frenzy, today’s market operates under strict regulatory oversight. The 11-day streak reflects a new era of “stability-first” growth, where volatility is a managed variable.

1.2 Technical Signals and Market Psychology

Post-rally corrections reveal strategic intent:

- Day 12: -0.1% decline—a “speed bump” to cool overheating.

- Day 13: +0.03% gain—institutional buyers absorbed selling pressure.

- Day 14: -0.07% retreat—a controlled reset before the next phase.

These micro-movements signal two things:

- Precision Control: The “National Team” (state-backed funds) engineered a soft landing, avoiding panic selling.

- Psychological Warfare: Ending at 11 days discourages FOMO-driven speculation, aligning with regulatory goals.

2. Market Dynamics: State Influence and Investor Behavior

2.1 The Role of Institutional Investors

The National Team’s playbook prioritizes longevity over quick wins:

- Price Capping: Keeping the Shanghai Composite below 3,000 points prevents irrational exuberance.

- Liquidity Moderation: Trading volumes stayed below 1.5 trillion CNY/day, avoiding the “2015-style” bubble.

This approach reduces systemic risks and discourages day-trading—a win for both stability and retail investors.

2.2 Retail Investor Considerations

For individual traders, the current climate offers:

- Lower Volatility: Smaller price swings mean fewer margin calls and easier position holding.

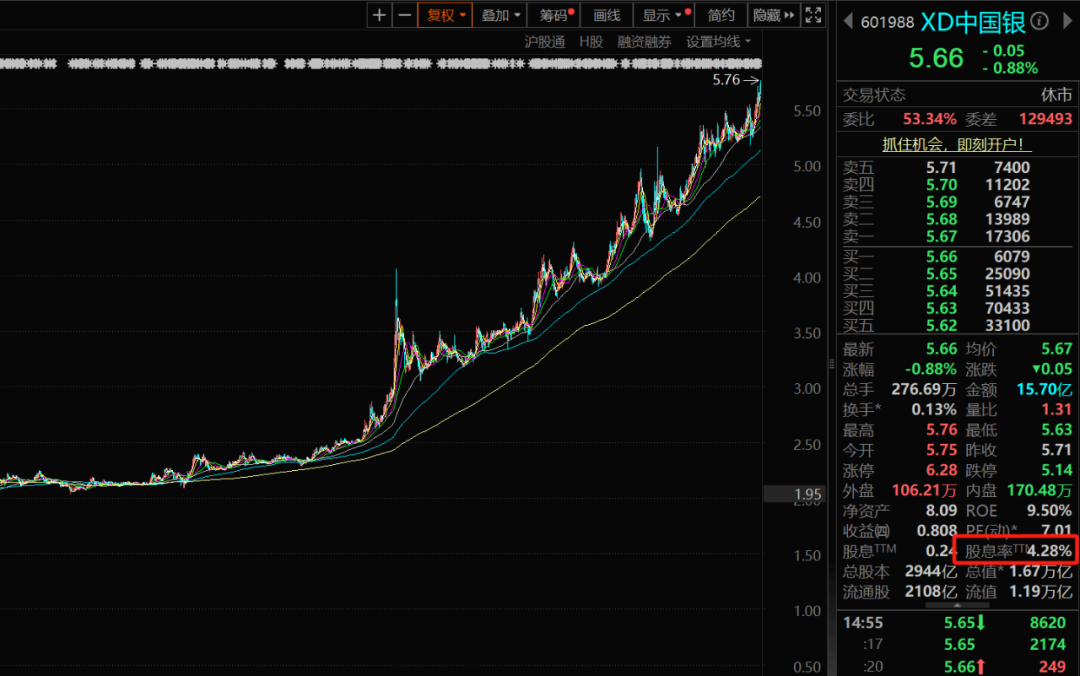

- Sector Rotation Alerts: Bank stocks’ 75% surge over two years signals a shift to undervalued sectors.

Example: Industrial and Commercial Bank of China’s (ICBC) dividend yield fell from 7% to 4% as prices doubled—a warning sign for yield-chasing investors.

3. Banking Sector: From High Dividends to Valuation Concerns

3.1 The Rise of Bank Stocks

Two factors propelled banks:

- Carry Trade Allure: Institutions borrowed at 2.25% to buy 6%+ yielding bank shares.

- Regulatory Backstop: Central bank liquidity measures prioritized systemically important banks.

3.2 Current Valuation Risks

However, the sector now faces:

- Yield Compression: ICBC’s dividend yield dropped to 4% as prices surged, losing edge over tech stocks like Midea Group (4.79% yield).

- Growth Limits: Banks’ 5% annual profit growth can’t justify further price gains. Investors will rotate to sectors with 15%+ CAGR potential.

4. Macroeconomic Factors Shaping the Market

4.1 Trade Policy and Global Linkages

Despite U.S.-China tensions:

- Export Resilience: China’s U.S. export dependency fell from 19.2% (2018) to 14.7% (2024).

- Diversification Wins: ASEAN and EU now account for 30% of exports, while cross-border e-commerce hit $369B in 2024.

4.2 Monetary Policy and Capital Flows

Key trends:

- Rate Dilemma: China’s 2.25% benchmark rate attracts equity flows but compresses bank margins.

- Foreign Interest: MSCI inclusion drove $1.2T in foreign A-share holdings by 2024.

5. Strategic Insights for Investors

5.1 Navigating the Current Landscape

Actionable tips:

- Quality Over Quantity: Target utilities (5%+ yields) and consumer staples with stable cash flows.

- Avoid Overcrowded Trades: Trim bank exposure and add green energy or AI stocks.

5.2 Long-Term Opportunities

Future growth engines:

- Digital Economy: Asia’s e-commerce sector grew 8.4% in 2024, led by Alibaba and JD.com.

- Regional Integration: RCEP boosted intra-Asia trade by 3%, benefiting logistics firms like SF Express.

6. Conclusion: Stability Amid Uncertainty

The A-share market’s 11-day rally was a masterclass in controlled growth—a balancing act between regulatory goals and market forces. While institutional players ensure short-term stability, long-term success hinges on:

- Structural reforms to boost productivity.

- Global cooperation to mitigate trade risks.

- Sector rotation to maintain momentum.

By understanding these dynamics, investors can navigate the A-share market with confidence—even amid global uncertainty.

Note: All data uses 1 USD = 7.2 CNY exchange rate. Sources include World Bank, Boao Forum, and market reports.