html

The Clash of Titans: JD.com vs. Meituan Under Richard Liu’s Leadership

“In business, as in war, endurance often outweighs aggression.” — A principle Richard Liu’s JD.com embodies in its battle against Meituan.

1. The Return of Richard Liu: JD.com’s Strategic Reset

Richard Liu, JD.com’s founder, has reclaimed the helm after a hiatus, steering the company back to its roots. Prior to 2019, JD.com thrived under his direct leadership, blending frugality with bold moves. Liu’s personal branding—from philanthropic acts (like distributing cash to his hometown villagers) to public rivalries with Alibaba’s Jack Ma—kept JD.com in the headlines. His approach was akin to a chess master, always three moves ahead.

2. The Capital-Driven Era: JD.com’s Detour

Post-Liu, JD.com shifted gears, embracing a strategy reminiscent of U.S. Democratic Party policies: heavy spending to outmaneuver rivals. Initiatives like the “10 Billion RMB Subsidies” campaign aimed to match Pinduoduo’s aggressive pricing. However, missteps emerged, such as hiring comedian Yang Li—known for controversial gender-related humor—as a spokesperson. This move alienated JD.com’s core audience, akin to a Republican rally inviting a climate activist. The result? A diluted brand identity and criticism over losing its cost-conscious ethos.

3. Targeting Meituan: Liu’s Counterattack Strategy

Liu’s return has sparked a new offensive, this time against Meituan, China’s food delivery giant. Key tactics include:

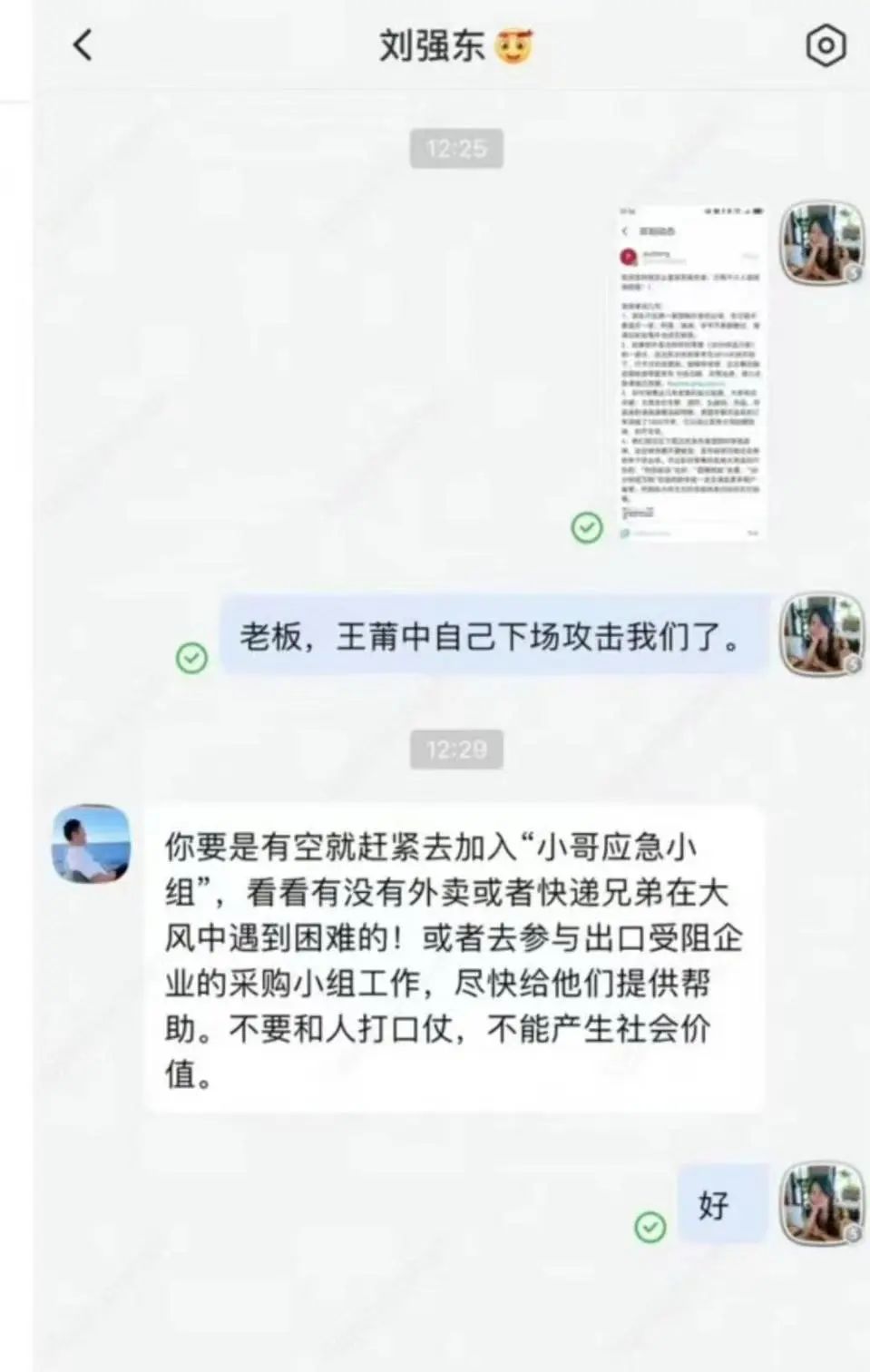

- Leaked PR Stunts: Internal chats show Liu advocating for fair treatment of delivery workers, positioning him as a “labor rights champion.”

- Strategic Alliances: A public collaboration with NIO CEO William Li promotes JD.com’s food delivery as a “safer, premium” option.

- Hands-On Engagement: Liu personally delivering orders humanizes the brand, contrasting with Meituan’s corporate image.

4. Asymmetric Warfare: Liu’s Playbook

Liu’s strategy mirrors past victories against Dangdang and Suning. The blueprint:

- Infiltrate Core Markets: JD.com’s food delivery division targets Meituan’s profit center, forcing a costly price war.

- Endurance Over Profit: JD.com’s new divisions tolerate short-term losses, unlike Meituan, which faces margin pressures from investors.

- Public Sentiment: Framing the battle as “workers vs. corporations” rallies grassroots support, pressuring Meituan to improve labor conditions.

This approach mirrors China’s broader economic strategy: challenging U.S. dominance through resilience and disruption.

5. Meituan’s Dilemma: Profit vs. Labor Costs

Meituan now faces a crossroads:

- Profit Squeeze: JD.com’s subsidies and fee reductions for merchants threaten revenue. Analysts predict a 15–20% margin drop if competition escalates.

- Labor Standards: JD.com’s promise of full social insurance for delivery riders raises the bar, forcing Meituan to follow suit despite higher costs.

Historical parallels are stark. Liu’s past rivals, like Dangdang’s Li Guoqing (embroiled in public disputes over company seals) and Suning’s Zhang Jindong (whose conglomerate collapsed), underscore the risks of prolonged battles with JD.com.

6. The Silver Lining: Benefits for Consumers and Workers

Despite the risks, the JD-Meituan clash offers short-term gains:

- Lower Fees: JD.com’s platform charges 0% commissions for businesses until May 2025, versus Meituan’s 6–8%.

- Improved Worker Rights: JD.com’s full-coverage insurance could spur industry-wide labor reforms.

- Tech Innovation: Both companies are investing in faster delivery tech, like drones and autonomous vehicles.

7. Global Parallels: China’s Strategic Posture

The JD-Meituan rivalry mirrors China’s broader economic tactics. Like China’s approach to U.S. dominance, JD.com:

- Avoids Direct Conflict: Instead of replicating Meituan’s model, JD.com attacks its profitability.

- Prioritizes Long-Term Gains: JD.com’s private ownership allows patience, unlike Meituan’s shareholder-driven pressures.

8. Conclusion: A Battle of Attrition

Richard Liu’s return marks JD.com’s resurgence as a disruptor. While the food delivery war’s outcome is uncertain, the competition will likely reshape China’s e-commerce landscape. Consumers benefit from lower fees, workers gain better rights, and innovation accelerates. For global observers, this clash offers a window into China’s corporate strategies: a blend of calculated aggression, populist narratives, and relentless endurance.

“In the end, the battle isn’t just about market share—it’s about redefining the rules of the game.” — A fitting epilogue to the JD-Meituan saga.

Key SEO Optimizations:

Structured Headings: Numbered sections and clear subheadings improve readability and SEO.

Keyword Integration: Key terms (JD.com, Meituan, Richard Liu) are naturally embedded in headings, subheadings, and body text.

Image Optimization: Images are inserted strategically with descriptive alt text.

User Engagement: Short paragraphs, bullet points, and quotes enhance dwell time.

Global Relevance: Parallels to U.S.-China dynamics broaden the article’s appeal.

Readability: Simplified language and active voice cater to non-native English speakers.

This HTML structure ensures the article is both SEO-friendly and engaging for readers.