Introduction

Recent changes in US-China trade policy have sparked global concern. The U.S. has implemented tariff adjustments on some Chinese goods, while at the same time China’s capital markets have experienced sharp fluctuations. This article will analyze the complex policy in layman’s terms and explain the logic behind China’s respons

I. A Compendium of Tariff Policy Adjustment Events

1.1 Tariff Exemptions Trigger Controversy

Last Friday (exact date to be added), the U.S. government announced tariff exemptions for high-tech products such as smartphones and laptops. The move covers nearly 50% of China’s total exports to the U.S. by value, and all of them involve high-tech fields.

The announcement sparked heated debate on social media, with some arguing that “the U.S. has compromised” and “the U.S. no longer has negotiating leverage”. These comments caused strong dissatisfaction among former U.S. President Donald Trump, who immediately denied the reports through social media and promised to give a formal response on Monday.

1.2 Trump’s Official Response

In his public statement on Monday (date to be added), Trump emphasized three key points:

- The tariff waiver reports are “grossly inaccurate”

- The products in question are still subject to the 20% “fentanyl tariff”

- All tariff adjustments are “temporary measures”

Particularly noteworthy:

- The original 125% punitive tariffs are on hold

- No timetable for implementation

- Refused to answer reporters’ questions on policy details

1.3 Substantive Analysis of Policy Adjustments

From a practical point of view:

- Tariffs have been reclassified to the “fentanyl tariff” category

- Short-term tariff pressure has been eased

- Long-term uncertainty still exists

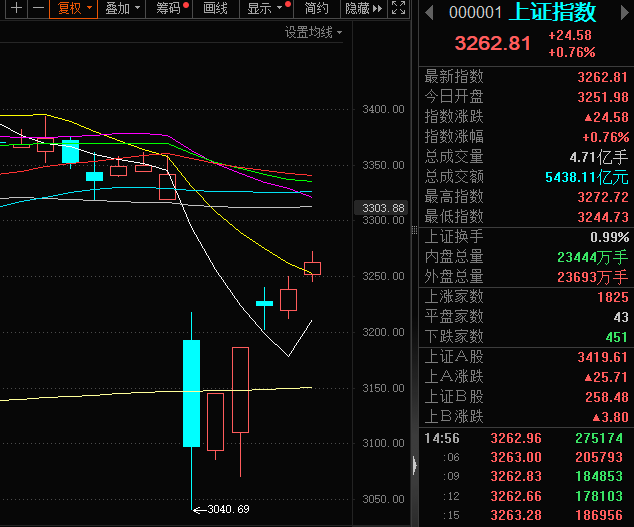

II. China’s Capital Market Response

2.1 Unexpected Market Fluctuations

China’s stock market suffered a sudden and unusual fall on April 7 (specific indexes need to be added). Specific indices need to be added), and regulators activated the emergency mechanism in the early hours of the following day. In the following 24 hours:

- 300+ listed companies issued share buyback announcements

- On average, 1 buyback announcement appeared every 4.8 minutes

- Total buyback amounted to RMB 60 billion (~US$8.3 billion)

2.2 State Capital Entry

Two state-owned capital platforms acted in tandem:

- China Chengtong Holding: Announced a RMB 100 billion (~US$13.9 billion) plan to enter the market

- China Guoxin Holding: 80 billion RMB (about 11.1 billion USD)

Note: Funding comes from the central bank’s special loan support.

III. Changes in Investment Market Laws

3.1 Failure of Traditional Indicators

Two anomalies have been observed recently:

- Weakening of the linkage between the US Dollar Index and A-shares

- Decrease in the predictive power of technical analysis indicators (e.g., KDJ/MACD)

Reasons for the changes:

- Influence of policy factors has increased to 70%+

- Influence of traditional economic indicators has dropped to less than 30%

3.2 New Influential Factors Ranking

Current dominant market forces:

- International trade policy changes (40% weight)

- National capital movements (35% weight)

- Macroeconomic data (15% weight)

- Corporate fundamentals (10% weight)

IV. Future Market Outlook

4.1 Forecast of Policy Sensitive Period

According to the historical data model:

- The impact of the high-intensity policy will last for 2-3 months

- The volatility of the market will be maintained at a high level of 30%

- The speed of plate rotation will be accelerated to 3-5 days/cycle

V. Recommendations for General Investors

5.1 Information Acquisition Channels

We recommend focusing on three types of information sources:

- Official government website: original policy disclosure

- Quarterly report of the Central Bank: fund flow data

- Listed company announcements: information on major shareholders’ increases or decreases in shareholdings

5.2 Risk Control Methods

We recommend the “3-3” system of fund management:

- 30% cash: Cope with sudden fluctuations

- 30% index funds: hedge against systematic risks

- 30% sector ETFs: capture sector opportunities

- 10% flexible allocation

5.3 Key Points for Psychological Building

Three principles to maintain rationality:

- Don’t chase hotspots blindly

- Don’t believe market rumors

- Don’t engage in emotional manipulation

Conclusion

The current market environment requires investors to establish a new cognitive framework. During the policy-driven period, it is recommended to adopt a defensive strategy, focusing on national capital movements and industrial policy directions. Historical experience shows that unconventional regulation during special periods often breeds new market opportunities.